Rekord

Solutions

The Industry Challenges

M&A professionals face deal-killing risk: one disputed corporate record or questioned board decision can destroy billion-dollar transactions and trigger massive legal liability.

The Deal-Breaking Stakes

- $50M average deal breakup cost when documentation disputes arise

- Fiduciary duty lawsuits reaching hundreds of millions in damages

- Shareholder litigation from questioned board decisions and equity changes

- Due diligence failures when corporate history cannot be verified

WHY CURRENT SOLUTIONS FAIL

Corporate documents can be altered. Board meeting minutes rely on trust, not proof. When deals are challenged, “trust our governance” isn’t enough.

THE NEW REALITY

Post-AI era demands mathematical certainty. Investors want proof they can verify independently. Smart corporations are moving beyond hope to mathematical guarantees.

Traditional vs. Rekord Approach

What You Need

Board Record Protection

Due Diligence Preparation

Deal Dispute Resolution

Equity Verification

Legal Defensibility

traditional systems

Document systems (easily disputed)

6 months of document review

2-year litigation battles

“Trust our cap table” claims

Challenged in court proceedings

rekord

Mathematical impossibility to alter

6 hours of verified records

2-day mathematical proof

Independent mathematical verification

Cryptographic certainty

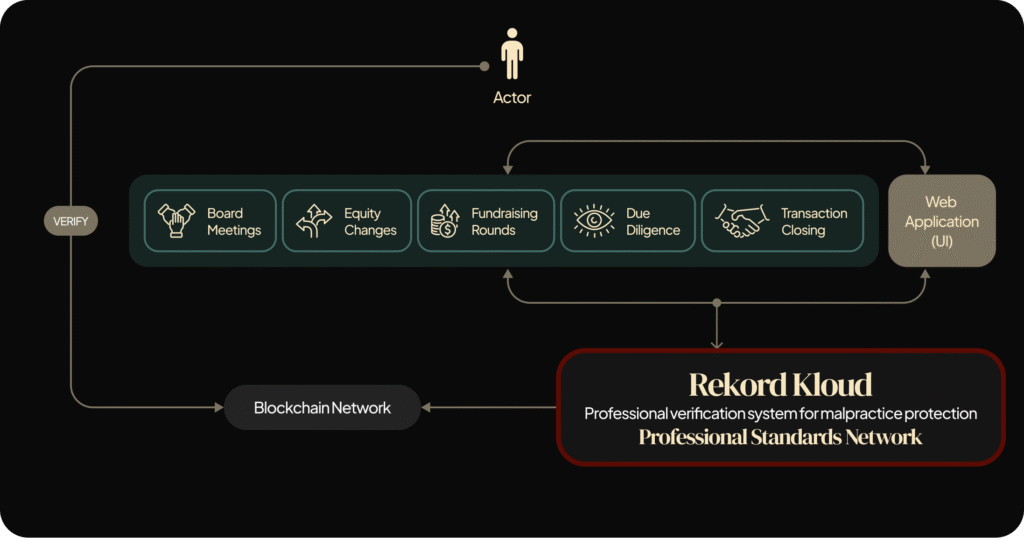

How It Works for Financial Services

Connect

Integrate with your existing trading systems, core banking platforms, and risk management tools in minutes.

Publish

Share cryptographic proof with investors, acquirers, and legal teams without exposing sensitive strategic information.

Link

Connect related corporate actions across multiple transactions while maintaining complete audit trails.

Verify

Every board resolution, equity issuance, and corporate decision gets mathematical verification the moment it’s approved.

Create Transparency

Generate immutable corporate trails that investors and acquirers can verify independently without accessing your systems.

Monitor with Rekord Kloud

Real-time dashboard shows verification status, deal readiness metrics, and corporate governance compliance.

Specific features that matter the most

Blockchain-Based Verification Built for corporate transactions

Every board decision, equity change, and fundraising event receives cryptographic fingerprinting that creates mathematical impossibility of unauthorized changes.

Deal Automation SEC, Delaware Law, Sarbanes-Oxley ready

Automated corporate compliance reporting with mathematical proof of governance. Turn months of due diligence into days.

Transparency Verify without exposing

Share cryptographic proof with investors and acquirers without revealing sensitive strategic plans or competitive information.

Trust Mathematical certainty over hope

Transform deal disputes into mathematical proof. When transactions are challenged, provide evidence, not explanations.