Rekord

Solutions

The Industry Challenges

Financial institutions face an impossible choice: spend millions on compliance systems that still fail when tested, or risk regulatory penalties that can destroy reputations overnight.

THE HIDDEN COST

- $2.3M average cost of regulatory investigations that could be resolved in hours

- 6-week audit preparation that pulls teams away from revenue-generating work

- Disputed trading records that create legal liability for years

- Compliance failures that trigger multi-million dollar fines

WHY CURRENT SOLUTIONS FAIL

Traditional database logs can be altered. Audit trails rely on trust, not proof. When regulators demand evidence, “trust us” isn’t enough anymore.

THE NEW REALITY

Post-AI era demands mathematical certainty. Regulators want proof you can verify independently. Smart institutions are moving beyond hope to mathematical guarantees.

Traditional vs. Rekord Approach

What You Need

Tamper Protection

Audit Preparation

Dispute Resolution

Regulatory Confidence

Legal Evidence

traditional systems

Database logs (easily modified)

6 weeks of manual work

18-month investigations

“Trust us” explanations

Questionable in court

rekord

Mathematical impossibility

6-minute automated reports

48-hour mathematical proof

Independent verification

Cryptographic certainty

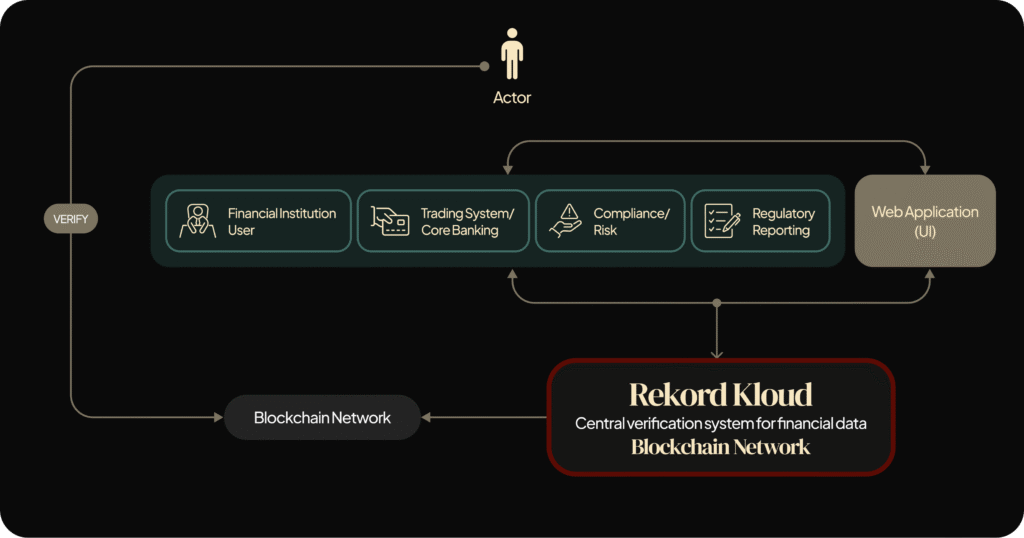

How It Works for Financial Services

Connect

Integrate with your existing trading systems, core banking platforms, and risk management tools in minutes.

Publish

Share cryptographic proof with auditors, regulators, and counterparties without exposing sensitive data.

Link

Connect related transactions across multiple systems while maintaining complete audit trails.

Verify

Every record gets mathematical proof it’s real. Can’t be faked.

Create Transparency

Generate immutable audit trails that regulators can verify independently without accessing your systems.

Monitor with Rekord Kloud

Real-time dashboard shows verification status, compliance metrics, and regulatory reporting readiness.

Specific features that matter the most

Blockchain-Based Verification Built for financial institutions

Every trade, transaction, and compliance record receives cryptographic fingerprinting that creates mathematical impossibility of unauthorized changes.

Compliance Automation DORA, MiFID II, Basel III ready

Automated regulatory reporting with mathematical proof of accuracy. Turn months of compliance work into minutes.

Transparency Verify without exposing

Share cryptographic proof with regulators and auditors without revealing sensitive trading strategies or client information.

Trust Mathematical certainty over hope

Transform data disputes into mathematical proof. When investigations happen, provide evidence, not explanations.