Rekord

Solutions

The Regulatory Challenge

Compliance agencies face an impossible task: verify organizational claims without the resources to audit every system or the expertise to detect sophisticated data manipulation.

The Oversight Problems

- Limited audit resources vs. thousands of regulated entities

- Sophisticated data manipulation that traditional audits miss

- Cross-border compliance verification challenges

- Legal challenges to regulatory findings based on data authenticity questions

WHY CURRENT SOLUTIONS FAIL

Self-reported data can be manipulated. Traditional audits rely on trust, not proof. When enforcement happens, “trust our findings” isn’t enough.

THE NEW REALITY

Post-AI era demands mathematical certainty. Courts want proof they can verify independently. Smart regulators are moving beyond hope to mathematical guarantees.

Traditional vs. Rekord Approach

What You Need

Audit Verification

Investigation Speed

Evidence Quality

Cross-Border Compliance

Legal Defensibility

traditional systems

Self-reported data (easily manipulated)

18 months of resource-intensive audits

12-month disputes over findings

“Trust local authorities” approach

Challenged in court proceedings

rekord

Mathematical impossibility to fake

18 days of automated verification

12-hour mathematical proof

Independent verification

Cryptographic certainty

How It Works for Financial Services

Connect

Integrate with existing regulatory reporting systems and compliance frameworks in minutes.

Publish

Share cryptographic proof with multiple regulatory bodies and enforcement agencies without exposing sensitive regulatory methods.

Link

Connect related compliance activities across multiple organizations while maintaining complete audit trails.

Verify

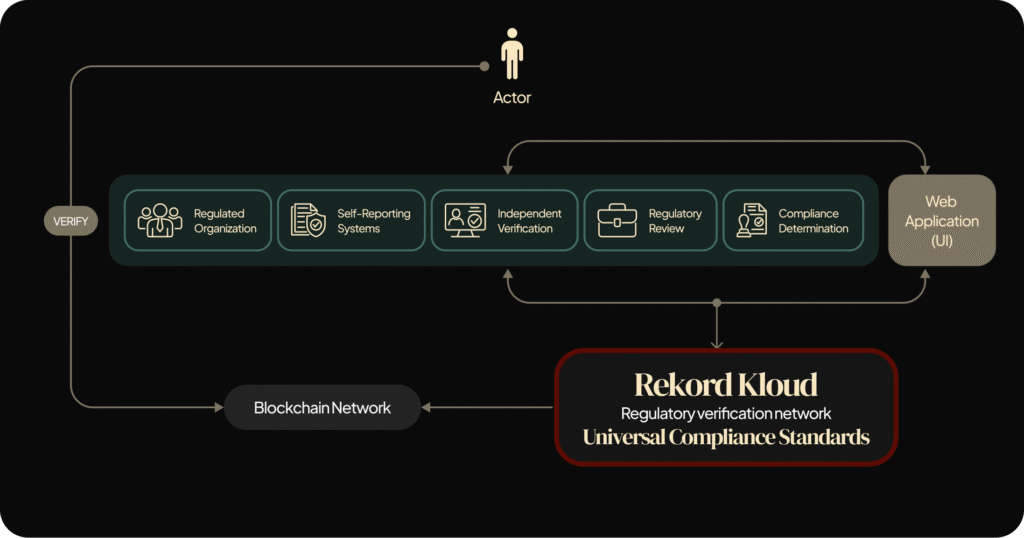

Every compliance claim, regulatory filing, and organizational report gets mathematical verification through independent channels.

Create Transparency

Generate immutable regulatory trails that can be verified across jurisdictions without accessing organization systems.

Monitor with Rekord Kloud

Real-time dashboard shows verification status, compliance metrics, and regulatory oversight readiness.

Specific features that matter the most

Blockchain-Based Verification Built for regulatory oversight

Every compliance claim, regulatory filing, and enforcement action receives cryptographic fingerprinting that creates mathematical impossibility of unauthorized changes.

Regulatory Automation Multi-jurisdiction ready

Automated regulatory verification with mathematical proof of compliance across different regulatory frameworks. Turn months of investigation work into days.

Transparency Verify without exposing

Share cryptographic proof with enforcement agencies and courts without revealing sensitive regulatory investigation methods.

Trust Mathematical certainty over hope

Transform regulatory investigations into mathematical proof. When enforcement happens, provide evidence, not explanations.